Professionalism and Integrity

Our industry experts are able to deliver better ideas and solutions embedded with a deep understanding of each client’ business and industry.

Sales Growth

Trade Deal Finalisation

More Suppliers Every Next Year

Greater Access to Financing and Capital

Gold Mining

Africa is a continent awash with gold. Small artisan miners can be found in every corner of the continent with a gold product no less in value to that of established mining companies. The Great Lakes Region is one of the most endowed countries in the word when it comes to natural and mineral resources. Gold mining is one or the major activities and we are deeply entrenched in this trade. With our knowledge of the Great Lakes Region, we have put together a team of experts to help you in all aspects of the gold trade.

The gold we sell is all mined ethically from small artisan and community mines dotted within Africa. Our gold supply is conflict free, unencumbered, free of liens and non-criminal origin and all the sources are verifiable. In addition the gold mined comes with all the necessary certification and documentation in accordance with Countries' laws and international conventions.

Buying gold from us is the best option given the intricacies of the gold market on the continent. With decades of experience and great success in the gold business, we are the reliable partner you need.

LBMA -17%

PARTNERS

IBA ensures appropriate governance over the IBA Precious Metals Auctions and the LBMA Gold Price benchmark, as well as ensuring standards of conduct are met. All participants are required to adhere to a Code of Conduct. IBA’s Precious Metals Oversight Committee, which has broad representation from the Gold and Silver markets – oversees the definition and methodology of LBMA Metals Prices.

Gold as a Precious Metal

Gold is a centuries-old precious metal and store of value highly regarded across various cultures worldwide. But seldom do people know or understand the process of forming the final gold product, be it a bar, coin, or piece of jewelry. Some may be surprised to learn that gold does not exist naturally as 100% pure. Gold ore is mined from the earth’s crust, comprising other types of less-desirable alloyed metals, including platinum, palladium, silver, and copper

Gold Refining

Refining precious metals means separating valuable gold from other “waste” materials. This is our work. Our chemists use a proprietary version of the “aqua regia” method. This method is used by most of the refineries in the world and was improved by our engineers to deliver the required results. Our state-of-the-art refinery using cutting-edge technology and the professionalism of our employees ensure the best and highest purity of gold. We deliver this with pride to our customers.

Gold Smelting

As the leading gold refinery in East Africa, we offer a full spectrum of smelting services to customers across the region. We specialize in smelting gold through Electric Induction Furnace. This environmentally friendly technique enables us to convert large lots of gold into grain, or smaller category bars of various sizes and purity levels. Our expertise allows us to convert gold according to the client’s request, while assuring the highest degree of quality and accuracy. Our state-of-the-art facilities coupled with our expertise enable us to simultaneously process huge lots of gold while ensuring the highest quality standards and the shortest turnaround times at a very competitive premium.

Gold Assaying

The responsibilities of our laboratory are gold assaying, metal analysis, and research and development (R&D). Assaying monitors the quality of the metal throughout the refining process, determining the fineness of gold. Our assaying technology includes traditional fire assay as well as spectrometry. All material arriving at the refinery, whether doré or scrap, is melted and samples are taken. As a general rule, each sample is divided into three parts, one for our customer, one for ourselves and one for arbitration, whenever deemed necessary.

For over 25 years, We sell precious metals in small and large quantities to buyers globally. We are a One-Stop Company with a Full Range of Services from Mining, Processing, Refining, Certification, Marketing, Testing, Storage, Export and Transportation. We have developed a network of related Service-providers that enable us to fully satisfy our clients without the client lifting a finger. In addition, we offer logistical support to our clients in form of Visa Acquisition, Inland Transfers and acquiring all necessary Export Licensing.

Creative Ideas

Our Clients will be impressed with how we handle their contracts and payments

Safe Delivery

Constant follow up with authorities and logistic companies for save delivery

24/7 Support

We Trade Coordinators shall always be on mobile 24/7 to handle your inquires

Honorable Award

We enjoy long and proven record of contract handling and processing with peace of mind

Sourcing gold from us means that you do not have to go through the arduous bureaucratic and sometimes difficult process of documentation and verification. Given our extensive knowledge and contacts on the continent, means acquiring all the necessary permits and documents will be a smooth and fast process saving you valuable time and money. our dedicated staff are always available to handle and solve all queries, whether in sourcing your products, verification of products and documents or the exportation.

Creative Ideas

Our Clients will be impressed with how we handle their contracts and payments

Safe Delivery

Constant follow up with authorities and logistic companies for save delivery

24/7 Support

We Trade Coordinators shall always be on mobile 24/7 to handle your inquires

Honorable Award

We enjoy long and proven record of contract handling and processing with peace of mind

Our team of Trade Advisors includes Academics, Researchers, Bankers and Trade Experts, with extensive experience and motivation and shall be responsible for evaluating and selecting investments opportunities, providing advice and financial planning services to clients, and managing the entire process. Such excellent client service skills, a strong knowledge of the International markets, and an excellent track record of success in the field, shall guarantee success and profitability for complete peace of mind.

Creative Ideas

Our Clients will be impressed with how we handle their contracts and payments

Safe Delivery

Constant follow up with authorities and logistic companies for save delivery

24/7 Support

We Trade Coordinators shall always be on mobile 24/7 to handle your inquires

Honorable Award

We enjoy long and proven record of contract handling and processing with peace of mind

1

Years Experience

1 +

happy importers

1

distributor

1

Trade Deals

Environment

Environmental management is a multi-faceted and multidisciplinary practice, that aims at safeguarding nature from potentially damaging business operations. The objective of environmental management is improved human life quality. It involves the mobilization of resources and the use of government to administer the use of both natural and economic goods and services.

- Industrial waste treatment up to international standards

- Exhaust fumes on time and carbon content as regulated

- Do not allow radioactive leakage to the external environment

Health & Safety

Health and safety means being aware of the risks and hazards in your workplace, and taking steps to protect yourself and others from harm. Safety is one of the highest priorities within TurkGroup. It is imperative that everyone follows the policies and guidelines to ensure their own safety and the safety of others around them.

- Absolutely safe working environment

- Get regular health checkup and 100% labor insurance allowance

- The diet of workers ensures hygiene and safety

Integrity In The Product

Product integrity as the ability of a product to meet or exceed a customer’s expectations for performance, quality and durability over the life of the product. Product Integrity is the source of sustainable competitive advantage. Products with integrity perform superbly, provide good value, and satisfy customers’ expectations in every respect, including such intangibles as their look and feel.

- High quality products reach international standards

- Sell products at market prices, Say no to high prices

- A team of professional engineers, dedicated customer support

6 NTERNATIONAL TRADE PROCEDURES

Our industry professionals are able to deliver better ideas and solutions embedded with a deep understanding of each client’ business and industry.

- Buyer issues LOI.

- Seller issues SCO.

- The buyer sends ICPO and a soft offer to the Seller (CIS Corporate Banking) enabling a soft probe by the seller.

- Seller provides draft contract and NCNDA/IMFPA to buyer to revise and confirm by initial.

- Buyers and sellers sign the base contract and NCNDA / IMFPA via email, which will be considered legally binding, each will submit contracts to their bank.

- Seller issues Commercial Invoice or Proforma Invoice and Buyer responds by issuing irrevocable, auto Revolving IRDLC – SBLC – BG revolving for per shipments.

- Seller responds by issuing 2% PB.

- Seller sends to buyer the cargo documents.

- Amount of L/C releases to Seller by submitting documents to Buyer’s bank or buyer makes payment for each shipment via T/T MT103 within 5 banking days.

- Commissions will be released to intermediaries in seller sides and buyer sides within 24 hours of buyer’s payment confirmation according to and based on the NCNDA/IMFPA and its paymaster.

- Buyer issues LOI.

- Seller issues SCO.

- Buyer sends ICPO and soft offer with full banking information allowing for soft probe to the seller.

- Buyer issues Commercial invoice or Performa invoice and NCNDA/IMFPA.

- Buyer pays to seller an agreed amount as a payment in advance.

- Seller sends to buyer the cargo documents.

- After delivering the cargo documents by the seller to the buyer, the remaining PI will be paid to the seller’s account.

- Commissions will be released to intermediaries in seller sides and buyer sides within 24 hours of buyer’s payment confirmation according to and based on the NCNDA/IMFPA and its paymaster.

- LOI should come with the letterhead of the final buyer and it must be official.

- The LOI should be in the name of Glob Agency Ltd Company and the name of the brokers must be mentioned in it.

- The signature of the company director and a copy of the passport and a copy of the power of attorney from the applicant company should be attached.

- The LOI must include a requested analysis of the destination port and the requested procedure by the buyer.

- All non-complete LOI requests will be returned by the company.

- All the requests should only be sent via the official email of the buyer to the official email addresses of the Glob Agency Ltd.

- Seller issue PI to Buyer, buyer sign and return it back.

- Buyer will pay the prepayment which is mentioned in PI in seller’s account as an advance.

- Seller will send (eg Q88) to buyer.

- Seller ship will move to the destination area which is notified by buyer.

- Buyer’s representative will make dip test on seller’s ship, after successful dip/test result, seller send the Invoice to buyer and buyer will settle the cost of Invoice to the seller account.

- STS (if present) operation will be started by the buyer.

Notes

- * In all procedures signs and official stamps via email are accepted by both parties.

- ** All LOI should be end buyer from the ultimate buyer, otherwise it will be returned.

- *** All the requests should only be sent via the official email of the buyer to the official email addresses of the Glob Agency Ltd

- **** LC – SBLC – BG draft should be announced by the seller and also be approved.

PRIMARY RULES

a. Commodity prices are estimated by the stock exchange.

b. The price of commodities is governed by the free market, obeying the law of supply and demand and world monetary policy.

c. Everything that is essential raw material, with a low level of industrialization, is called a commodity.

d. Commodity prices are strongly related to world productivity, since they are produced in large quantities, with no difference between brands, and can be stored without loss of quality.

To begin your purchase negotiation, we ask that you strictly follow the SALE PROCEDURES below.

- The buyer issues ICPO (Irrevocable Corporate Purchase Order) and RWA/BCL as POF Proof of Funds.

- Seller / Exporter issues FCO (Full Corporate Offer).

- Buyer returns signed and stamped FCO.

- The seller issues the draft contract.

- Buyer returns draft of signed, stamped and scanned contract by email and will be considered legal and official Purchase and Sale Agreement until copies are exchanged.

- The seller issues Commercial Invoice.

- The buyer returns the stamped and signed Commercial Invoice.

- Buyer submits draft of SBLC / ARDLC / DLC.

- The seller returns the above bank instrument with possible changes.

- The buyer’s bank issues SBLC / ARDLC / DLC (MT 700/760) as a guarantee for one month and sends it to the seller’s bank within 5 days. The bank instrument must be revolving, transferable, irrevocable, divisible, operational, renewable and confirmed by top 50 bank. Cash payment by MT 103 according to presentation of shipping documents (B / L + SGS).

- Following the open banking instrument, the seller’s bank sends the buyer’s bank a 2% Performance Bond (PB) in the amount of a remittance and a Proof of Product (POP) within 5 days.

- The buyer will receive an invitation letter to accompany the shipment at the port.

- Within 30/40 days the ship will be loaded.

- Payment against BL and SGS shipping documents, as per item 10.

- Ship’s release.

*NOTES:

- Referring to item 3, the presentation of BCL or RWA as POF (Proof of Funds) is indispensable to continue trading.

- All submitted documents must be issued on stamped letterhead, signed by the CEO and in PDF format.

- Documents such as LOI / ICPO will only be reviewed and accepted if they meet the seller’s requirements, such as:

- Buyer issues ICPO along with company profile, refinery verifies buyer’s ICPO with company profile.

- Seller issues Full Corporate Offer FCO for buyer to sign and return, upon issues the Sale & Purchase Agreement (SPA) open for amendment, buyer countersign and send back in word format. Seller confirms any amendment and sends the final SPA to buyer in PDF format for buyer’s confirmation & acceptance.

- Seller issue below partial POP documents to buyer via email to buyer’s secured email address;

- Company registration certificate of incorporation- - Commitment to supply

- - Certificate of origin

- - Product passport quality & quantity at country of origin (analytical report by authorized petroleum laboratory)

- - Approval to export (export license)

- Buyer confirms the receipt of the partial POP documents and Seller sends to buyer the Attestation Act of Transfer, buyer signs and returns and obtains the Allocation Passport Certificate [APC] documents by securing a legitimate approval for the Transfer of Ownership Title/Allocation by the relevant authorities from seller’s name to buyer’s name, which identifies the buyer as title holder of the allocation to enable the lodging of the Contract with their respective banks.

- Seller Legalizes & Notarizes the SPA and sends to buyer the Legalized Attestation Act of Transfer and the Allocation Passport Certificate [APC] & change of ownership documents along with The Legalized & Notarized Hard Copy SPA via email. seller’s bank sends through swift the proof of product (pop) documents the full POP shall include the following documents;

- - Seller releases Payment to all Intermediaries involve as per the signed NCNDA/IMFPA.

- - Product/production Allocation Application Permits

- - Product/production Allocation Ownership Title

- - Application and Ownership of Export Permits

- - Export Tax and Duties Payment Receipts

- - Bulking Storage Tank & Payment Receipts

- - Certificate of Analysis G. Certificate of Origin and Customs Declaration

- - Certificate of Quality

- - Certificate of Weight

- - Bill of Lading

- - Dip Test Authorization (only applies to product lifted from storage or transfer tanks)

- - Copy of the Charter Party Agreements to Transport the Product to Discharge Port

- - Copy of the Refinery Commitment to Produce the Product

- Within five (5) banking days, buyer’s bank sends Irrevocable Non-Transferable DLC MT700, MT103, T/T to Seller Fiduciary bank as Proof of Funds (POF) for the first shipment value and send swift copies to seller. Seller issues 2% PB to buyer.

- Buyer confirms the receipt of the partial POP documents and Seller sends to buyer the Attestation Act of Transfer, buyer signs and returns and obtains the Allocation Passport Certificate [APC] documents by securing a legitimate approval for the Transfer of Ownership Title/Allocation by the relevant authorities from seller’s name to buyer’s name, which identifies the buyer as title holder of the allocation to enable the lodging of the Contract with their respective banks.

- Buyer issues ICPO along with company profile, refinery verifies buyer’s ICPO with company profile.

- Seller signs NCNDA/IMFPA between all intermediaries involved with the Notarized Copy sent to Seller Bank. Seller issues Invitation Letter and arrange to Invite the Buyer & Buyer’s Delegates to come and physically Inspect the goods, view seller’s facility and witness loading at the loading port in Russian Federation (Optional) if the buyer decides not to come as it can still be skipped)

- Shipment commences as per signed Contract delivery schedule.

- Buyer releases Payment to seller by TT/MT103 upon the receipt of the Shipping Documents and confirmation of the Q & Q at destination unloading port.

- Seller releases Payment to all Intermediaries involve as per the signed NCNDA/IMFPA.

DOCUMENTS AND TRANSACTIONS

Our industry professionals are able to deliver better ideas and solutions embedded with a deep understanding of each client’ business and industry.

What is the Letter of Intent (LoI)?

An LOI (Letter of Intent) is not a contract. Letters of intent serve to notify the seller that the buyer wishes to enter into negotiations to purchase. They do not contractually oblige either the buyer or the seller to go through with the trade.

Letters of intent should be regarded only as an opening point. Issuing an LOI does not make the buyer culpable for anything written in it. Until a contract is agreed upon and signed, both parties are free to back out of negotiations at any time, and buyers cannot be held liable for statements made in the LOI.

Sample: Letter of Intent

What is the Soft Corporate Offer (SCO)?

Based on the Letter of Intent, a Soft Corporate Offer is issue by the Seller - on the company’s letterhead - expressing product specifications as well as the terms and conditions of the transaction. SCO furnishes a prospective buyer with enough understanding of a seller's modus operandi. It gives room to the buyer for negotiation as a buyer might request an alteration of terms and conditions. Generally, SCO is preferred in the import/export business involving commodity sales.

Upon receipt and acceptance of the Soft Corporate Offer (SCO), the Seller will be informed about the Buyer’s coordinates and after that, Seller issues a Full Corporate Offer (FCO) including full coordinates (registered address, plus office address (if different) plus phone, fax, corporate email), of the Bank’s recognized Seller, Company registration number of the Seller entity, Seller Code, Signature and Seal of the Seller matching signature of passport and if possible a copy of the Registration document properly addressed to the Buyer with corresponding Fee Agreement, draft Sales & Purchase Agreement and Seller lawful signatory’s full size color passport copy.

SCO Validity

SCO validity is 7-14 days from the date of issue. If the Buyer agrees to the SCO, He/She will be required to provide his complete coordinates/details in order for the Seller to issue Full Corporate Offer directly to the Buyer.

Sample: Soft Corporate Offer

What is the Full Corporate Offer (FCO)?

Upon the acceptance of the SCO, the FCO issue by the Seller - on the company’s letterhead - addressed specifically to the Buyer, expressing product specifications as well as the terms and conditions of the transaction. An FCO is not “full” without being addressed to the name of a specific party representing a buyer.

The offer must curtail information such as:

- Name of commodity

- Quantity

- Discharge port and type of shipment

- Price

- Origin

- Type of payment accepted

- Procedure to purchase the product, and more

FCO Validity

FCO validity is 14 days from the date of issue. If the Buyer agrees to the FCO, He/She will be required to provide further details such as Proof of Fund in order to proceed to Sales and Purchase Agreement (SPA)

Sample: Full Corporate Offer

What is Irrevocable Corporate Purchase Order (ICPO)?

ICPO is a document drawn up by commercial buyers. The buyer sends ICPO and a soft offer to the Seller (CIS Corporate Banking) enabling a soft probe by the seller

It contains:

Important Notes

- The Seller issues and delivers to Buyer four (4) copies of a signed Purchase and Sale Agreement; the Buyer signs and returns two (2) copies to Seller.

- Once submitted to the Vendor, it is deemed to be binding and the Corporation is obliged to complete the sale.

- The Seller supplies directly to Buyer evidence of legal ownership, current Assay Report, current Bank Statement and/or any other documentation that may be required by the Buyer to qualify the Seller’s offer. A Letter of Readiness (LoR), issued by the Seller’s bank and addressed to the Seller, is compulsory.

What is the Irrevocable Master Fee Protection Agreement (IMFPA)

Buyers and sellers sign the base contract and NCNDA / IMFPA via email, which will be considered legally binding, each will submit contracts to their banks

IMFPA

is a critical document that outlines the obligations and commitments of various parties involved in a transaction. The IMFPA (Irrevocable Master Fee Protection Agreement) is a type of contract used in international trade to protect the fee (commission) of the intermediary (Broker) who mediates in transactions, mainly for the purchase of commodities or merchandise negotiated in bulk such as food, raw materials, minerals, etc. The fee of the broker is only paid, either for the buyer or the seller or both, when the transaction is completed and the commission is automatically transferred from the buyer´s or seller’s bank account to the broker's account.

The Buyer responds with a signed and sealed Letter of Intent (LOI), properly addressed to the Seller, with a Buyer’s Code indicating procedures for acceptance and a separate IMFPA for Buyer’s side intermediaries and Mandates

NCNDA

The NCND Non-Circumvention & Non-Disclosure Agreement is a type of contract used by Intermediaries of international trade to protect the commissions due for the services provided to its clients: promotion of business, putting into contact with third parties, assistance in the contract negotiation and during the performance of the contract.

The NCND Contract is divided into two parts:

Part A: Special Conditions, setting out the terms that are special to a particular NCND agreement, and which must be filled in by the parties according to their particular needs, and;

Part B: General Conditions, setting out standard terms common to all contracts incorporating the ICC General Conditions for Non-circumvention & Non-disclosure Agreements.

The Parties that sign the Contract should use both Parts: articles in Part A require a choice between different alternatives (checking the box in each section); articles in Part B are standard conditions that complete Part A.

This model contract is used mainly for the intermediation of trade operations of different products (food, raw materials, and minerals) that are sold in large quantities as well as industrial products (machinery) and services of high a price.

Sample: IMFPA Agreement

Sample: NCND Contract

What is the Invoice?

A commercial invoice is a contract of sale or a transaction of sorts between the shipper and the receiver. It provides key information for customs to clear your goods and determine any government charges such as duties and taxes.

Seller issues Commercial Invoice or Proforma Invoice and Buyer responds by issuing irrevocable, auto Revolving IRDLC – SBLC – BG revolving for per shipments

Sample: Commercial Invoice

What are the types of Payment Promises IRDLC – SBLC – BG

Upon issuing the Commercial Invoice or Proforma Invoice by the Seller, the Buyer responds by issuing irrevocable, auto Revolving IRDLC – SBLC – BG revolving for per shipments.

Bank Guarantee

The guarantee is issued upon receipt of a request from 'applicant' for some purpose/transaction in favour of a 'Beneficiary'. The 'issuing bank' will pay the guarantee amount to the 'beneficiary' of the guarantee upon receipt of the 'claim' from the beneficiary.

Letter of Credit

Letters of Credit (LC) are widely used in international practice for convenience of international trade transactions and elimination of possible risks.

Due to frequent usage within the international collaboration, the names of LC types are given in English as well.

Types of Letter of Credit

1. Irrevocable LC. This LC cannot be cancelled or modified without consent of the beneficiary (Seller). This LC reflects absolute liability of the Bank (issuer) to the other party.

2. Revocable LC. This LC type can be cancelled or modified by the Bank (issuer) at the customer's instructions without prior agreement of the beneficiary (Seller). The Bank will not have any liabilities to the beneficiary after revocation of the LC.

3. Stand-by LC. This LC is closer to the bank guarantee and gives more flexible collaboration opportunity to Seller and Buyer. The Bank will honour the LC when the Buyer fails to fulfill payment liabilities to Seller.

4. Confirmed LC. In addition to the Bank guarantee of the LC issuer, this LC type is confirmed by the Seller's bank or any other bank. Irrespective to the payment by the Bank issuing the LC (issuer), the Bank confirming the LC is liable for performance of obligations.

5. Unconfirmed LC. Only the Bank issuing the LC will be liable for payment of this LC.

6. Transferable LC. This LC enables the Seller to assign part of the letter of credit to other party(ies). This LC is especially beneficial in those cases when the Seller is not a sole manufacturer of the goods and purchases some parts from other parties, as it eliminates the necessity of opening several LC's for other parties.

7. Back-to-Back LC. This LC type considers issuing the second LC on the basis of the first letter of credit. LC is opened in favor of intermediary as per the Buyer's instructions and on the basis of this LC and instructions of the intermediary a new LC is opened in favor of Seller of the goods.

8. Payment at Sight LC. According to this LC, payment is made to the seller immediately (maximum within 7 days) after the required documents have been submitted.

9. Deferred Payment LC. According to this LC the payment to the seller is not made when the documents are submitted, but instead at a later period defined in the letter of credit. In most cases the payment in favor of Seller under this LC is made upon receipt of goods by the Buyer.

10. Red Clause LC. The seller can request an advance for an agreed amount of the LC before shipment of goods and submittal of required documents. This red clause is so termed because it is usually printed in red on the document to draw attention to "advance payment" term of the credit.

What is the Performance Bond (PB)?

Upon issuing the LC/BG by the buyer, the Seller responds by issuing 2% PB

A performance bond is a financial guarantee that the terms of a contract will be honored. If one party to a contract cannot complete their obligations, the bond is paid out to the other party to compensate for their damages or costs. The Miller Act instituted the requirement of placing performance bonds.

Performance bonds are contracts involving three entities – the obligee (customer assigning the job), the principal (contractor doing the job), and the surety (financial entity issuing the bond). As the name implies, the bank guarantees that a borrower will fulfill its obligations to a contractor with bank guarantees.

Advantages and Disadvantages of a Performance Bond

Performance bonds protect the contracting party in the event that their contractor may become insolvent or otherwise unable to meet the terms of a contract. If the costs of completing the project overrun their projections, the obligee will not be responsible for the additional expenses. This reduces the risk for developers or other companies when they engage in large-scale construction projects.

However, there are some risks to consider. The surety may attempt to argue that the obligee did not comply with all the requirements of the bond in order to deny payment. Or, they may try to get the obligee to settle on a lesser amount.

Moreover, it is up to the obligee to calculate the financial cost of a failure by the contractor. If the obligee underestimates the cost of non-performance, they will have to absorb those extra costs on their own.

Seller sends to buyer the cargo documents

What are the Cargo Documents?

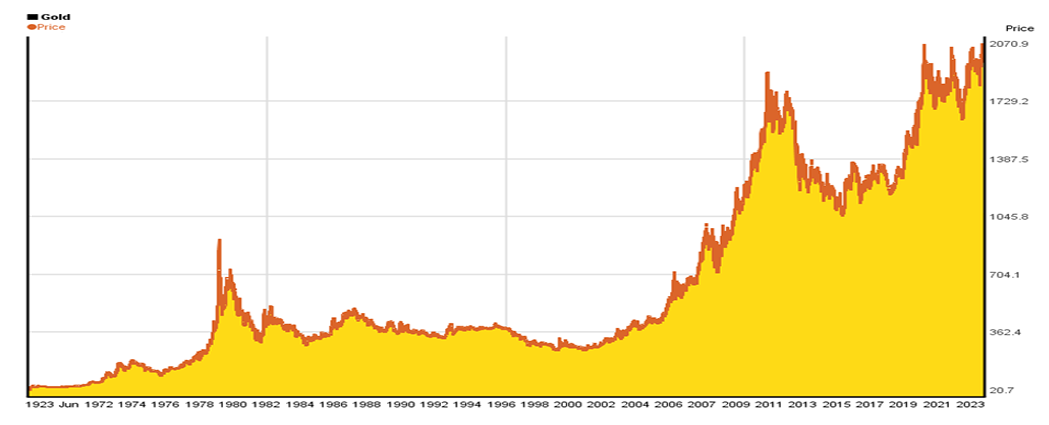

GOLD PRICES OVER 100 YEARS

Our Teams

EMAAD MUHANNA

Jennifer Mandella

Carmel Nelson

DAVID Lynch

Natasha Scott

David Wang

Our Precious Metals Catalogue

FAQ Of Customer

TURKGROUP is an international trade company with an extensive network of suppliers worldwide. Our team of knowledgable friendly experts will source your product with absolutepeace of mind and security

TURLGROUP (TGI) is a consulting firm involved in field research, consulting as well as international trade along with its sister firms Second Crossing for Economic Development (SCOD) in Egypt, World Research Organisation in South Africa, Izis Press for publications in Egypt. Furthermore, TGI has been involved in import and export of precious metals, heavy machines and the Petroleum industry.

Our Code establishes the principles—fundamental elements that define who we are and how we build and maintain trust—that guide how we live our firm’s purpose, mission, and values every day. It is representative of our commitment and obligation to our clients, to our communities, and to one another. It builds upon the expectation that we comply with all laws and regulations.

Our Code guides us toward integrity-based decision making and allows us to lead in ways that earn and build trust. It outlines the behaviors expected from each of us, what to do, and where to go if we have questions, no matter where we are in the world.

To help our clients make distinctive, lasting, and substantial improvements in their performance and to build a great firm that attracts, develops, excites, and retains exceptional people. We are a values-driven organization. Our values reflect the thinking of our founder, Emaad Muhanna, who was a major force in shaping the firm. Our values have been updated in small ways to reflect the changing times. They inform both our long-term strategy as a firm and the way we serve our clients on a daily basis. We put aside one day a year to reflect as a group on what our values mean to both our work and our lives.